Appraisal-Free Purchase Mortgages

Available from Fannie and Freddie,

September 1, 2017

Fannie Mae and Freddie Mac have recently come out with new directives and notifications relating to requirements on appraisals ...

What are those changes?

What are those changes?As of September 1, 2017: On transactions fulfilling "certain specific limited requirements" set forth by Fannie and Freddie, appraisals will no longer be required.

First and foremost: This does NOT mean that the mortgage industry has forgotten the lessons learned during the meltdown of the late 2000's. Only mortgage applicants with very low credit risk will be capable of taking advantage of these new directives.

This new directive signals: Fannie and Freddie feel they are now capable of streamlining the current mortgage process via these actions. Each GSE has massive amounts of appraisal data at their disposal within their data bases. That data now frees them to extend this benefit.

It must also be pointed out: In order for a Borrower -transaction to take advantage of this new directive, the info that Fannie Mae and Freddie Mac have at their disposal must support the stated Purchase Price of the transaction.

Remember hoping for "Common Sense Lending"? Hopefully, these changes represent a step in that direction.

Common sense would lead you to ask ...

"Why require an Appraisal, if a transaction's mortgage application features the following attributes"?

- More than Sufficient Down Payment

- More than Sufficient Credit Scores

- Above the Norm for Employment Stability/Income

- Sufficient retained Assets (Reserves)

Accumulatively, they point to a low-risk loan for any Lender.

But the positives listed above must also be supported by the:

- Purchase Contract

- An Automated Valuation report that is "within a very low variance"

How can this change offered by Fannie Mae and Freddie Mac benefit the Borrower/Buyer?

This new "no Appraisal" approach can eliminate 7 to 10 days in mortgage processing time on a loan. It can also result in a monetary savings of around $500 in appraisal charges for a Buyer/Borrower.

Buyers obtaining a Fannie Mae loan can retain their option to have an appraisal conducted during their transaction if they so choose. However, the Borrower must pay for any appraisal performed. (Fannie Mae also distinguishes itself by allowing property waiver inspections on select purchase loans.)

On the majority of transactions: Appraisals will still be required ... at least for now. But as automation becomes more reliable, more "appraisal-free" options may be added to Conventional Financing. (Experts guesstimate that 5% of deals will qualify ... so 95% will still require an Appraisal).

I don't expect to see the same option become available in FHA, VA, or USDA Rural Development lending.

Why?

Each of them offers high Loan-to-Value Loan Programs where appraised value is critical. The condition of a property is also critical within these lending programs so appraisals will continue to serve as their "second set of eyes".

Still, the elimination of even a small number of appraisals should help increase the fluidity and flow of residential real estate transactions. That's something industry professionals and consumers alike will enjoy ...

I'm easily found at:

Gene Mundt

Mortgage Originator - NMLS #216987 - IL Lic. #031.0006220 - WI License 216987

American Portfolio Mortgage Corp.

NMLS #175656

Direct: 815.524.2280

Cell or Text: 708.921.6331

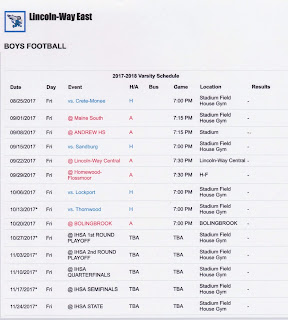

eFax: 815.524.2281

Gene Mundt, Mortgage Originator, an Originator with 40 years of mortgage experience, will offer you exemplary mortgage service and advice when seeking: Conventional, FHA, VA, Jumbo, USDA, and Portfolio Loans in Chicago and the greater Chicagoland region, including: The Lincoln-Way Area, Will County, (New Lenox, Frankfort, Mokena, Manhattan, Joliet, Shorewood, Crest Hill, Plainfield, Bolingbrook, Romeoville, Naperville, etc.), DuPage County, the City of Chicago, Cook County, and elsewhere within IL & WI.

Referrals are Greatly Appreciated & Welcomed!