The skies across Will County will light up with fireworks, during the upcoming 2018 - 4th of July holiday ...

There's a huge assortment of municipalities and groups hosting firework shows and spectaculars (sometimes as part of a community fest) throughout Will County. Below you'll find a handy list I've compiled of those shows.

Take this opportunity along with your family and friends to celebrate our freedom, our Country's rich history, its people, and many wonderful accomplishments ...

2018 - Communities of Will County

4th of July Fireworks

4th of July Fireworks

Date: July 4th - Start: 9:35 pm

Where: RiverEdge Park - 360 N Broadway St., Aurora

(Portions of Aurora are in Will County)

Where: RiverEdge Park - 360 N Broadway St., Aurora

(Portions of Aurora are in Will County)

Beecher Fireworks

Date: July 4th - Start: 9:30 pm

Where: Firemen's Park - 673 Penfield Street, Beecher

Date: July 4th - Start: 9:30 pm

Where: Firemen's Park - 673 Penfield Street, Beecher

Bolingbrook's 4th of July Fireworks

Date: July 4th - Start: @ Dusk/9:45 pm

Where: Bolingbrook Golf Club - 2001 Rodeo Drive, Bolingbrook

Braidwood Summerfest - Fireworks

Where: Braidwood City Park - 245 W. 1st Street, Braidwood

Channahon Independence Day Fireworks

Date: July 4th - Start: 9:15 pm

Where: Community Park - 23200 W. McClintock Rd., Channahon

Frankfort Fourth of July

Date: July 4th - Start: Dusk/9 pm

Where: Main Park - 200 S. Locust Street, Frankfort

Joliet Independence Day Celebrations

Date: July 3rd - Start: Dusk

Where: Bicentennial Park - 201 W. Jefferson St., Joliet

Date: July 4th

Start: Dusk/9:20 pm

Where: Joliet Memorial Stadium - 3000 W. Jefferson St., Joliet

Date: July 4th - Start: Dusk/9 pm

Where: Main Park - 200 S. Locust Street, Frankfort

Joliet Independence Day Celebrations

Date: July 3rd - Start: Dusk

Where: Bicentennial Park - 201 W. Jefferson St., Joliet

Date: July 4th

Start: Dusk/9:20 pm

Where: Joliet Memorial Stadium - 3000 W. Jefferson St., Joliet

* Lakewood Falls Fireworks

Date: June 30th - Start: Dusk

Where: Bruce Ponti Park - 13909 S. Budler Rd., Plainfield

Lemont Park District Freedom Days Fireworks

Date: July 3 - When: Dusk/9:30 pm

Where: Centennial Park - 16028 127th St, Lemont

Date: July 3 - When: Dusk/9:30 pm

Where: Centennial Park - 16028 127th St, Lemont

(Portions of Lemont are in Will County)

Lockport 4th of July Fireworks

Date: July 3rd - Runs: 8 to 10 pm

Where: Dellwood Park - 18th & Lawrence Avenue, Lockport

Date: July 3rd - Runs: 8 to 10 pm

Where: Dellwood Park - 18th & Lawrence Avenue, Lockport

Mokena 4th of July Fireworks

Date: July 4th - Start: Dusk

Where: 10925 W. LaPorte Rd., Mokena

Naperville 4th of July Fireworks (Part of Ribfest Celebration)

Date: July 4th - Start: 9:30 pm

Where: Knoch Park - 724 S. West Street, Naperville

Date: July 4th - Start: Dusk

Where: 10925 W. LaPorte Rd., Mokena

Naperville 4th of July Fireworks (Part of Ribfest Celebration)

Date: July 4th - Start: 9:30 pm

Where: Knoch Park - 724 S. West Street, Naperville

Date: July 4th

Start: 7 pm (Fireworks at Dusk)

Where: Village Commons - 1 Veterans Pkwy, New Lenox

Park Forest Independence Day Fireworks

Date: July 4th - Start: 9:15 pm

Where: Central Park - 410 Lakewood, Park Forest

Plainfield Fireworks

Date: July 3rd - Start: Dusk

Where: Plainfield Central HS - 24120 W. Fort Beggs Drive, Plainfield

Date: July 4th - Start: 9:15 pm

Where: Central Park - 410 Lakewood, Park Forest

Plainfield Fireworks

Date: July 3rd - Start: Dusk

Where: Plainfield Central HS - 24120 W. Fort Beggs Drive, Plainfield

Village of Romeoville Fireworks

Date: July 3rd - Start: 9:30 pm

Where: Village Park - 900 W. Romeo Rd., Romeoville

Tinley Park Fireworks

Date: July 4th - Start: 9:15 pm

Where: McCarthy Park - 16801 W. 80th Avenue, Tinley Park

Date: July 3rd - Start: 9:30 pm

Where: Village Park - 900 W. Romeo Rd., Romeoville

Tinley Park Fireworks

Date: July 4th - Start: 9:15 pm

Where: McCarthy Park - 16801 W. 80th Avenue, Tinley Park

Wilmington Independence Day Fireworks

Date: July 4th - Start: Dusk

Where: North Island Park, Wilmington

Date: July 4th - Start: Dusk

Where: North Island Park, Wilmington

Enjoy a Wonderful and Safe 4th of July!

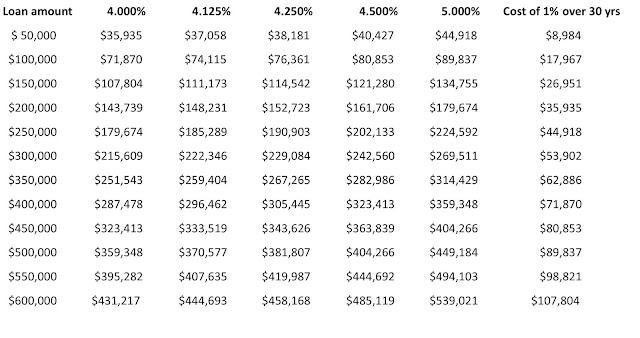

* Hoping to Buy or Refinance a home within Will County, IL? Contact me today! I'll put my 40+ years of mortgage experience and expertise hard to work on your behalf.

I can be easily found at:

I can be easily found at:

Gene Mundt

Mortgage Originator - NMLS #216987 - IL Lic. #031.0006220 - WI Lic. #216987

American Portfolio Mortgage Corp.

NMLS #175656

Direct: 815.524.2280

Cell/Text: 708.921.6331

eFax: 815.524.2281

Gene Mundt, Mortgage Originator, an Originator with 40+ years of mortgage experience, will offer you exemplary mortgage service and advice when seeking: Conventional, FHA, VA, Jumbo, USDA, and Portfolio Loans in Chicago and the greater Chicagoland region, including: The Lincoln-Way Area, Will County, (New Lenox, Frankfort, Mokena, Manhattan, Joliet, Shorewood, Crest Hill, Plainfield, Bolingbrook, Romeoville, Naperville, etc.), DuPage County, the City of Chicago, Cook County, and elsewhere within IL & WI.

Referrals are Appreciated and Welcomed!