Why and How to Avoid Lender Remorse

No matter the size of the business, businesses today typically choose to incorporate some type of social media into their marketing efforts ...

That's certainly true for me. As a Mortgage Originator, I participate in many of the major social media outlets.

That's certainly true for me. As a Mortgage Originator, I participate in many of the major social media outlets. Recently, I checked-in on one of the online groups I take part in. To participate as a business in this particular group, a business must be located and conducting business within its specific business boundaries.

"Bonafides" must be proven too. A business must provide group administrators with proof of their business for verification ... meaning business info, licenses, etc.

A large array of businesses are represented within the group. As this group is related to "home" services, you'll find everything from plumbers to landscapers ... appliance repair to home organizers ... and much more.

A string of consumer requests for business recommendations steadily appears in the feed. The referrals and feedback provided to the group are timely and based on past personal experiences with contractors/businesses. That makes the information exchanged there very valuable to consumer and business alike.

But while the work (and professionals) sought in the majority of online requests and feedback represent a future expenditure of money, few of the jobs/work discussed are equal in expenditure to those costs associated with the act of buying, selling, or financing a home. Regardless of that fact, few requests for recommendations and referrals for a Mortgage Originator or mortgage advice are ever found.

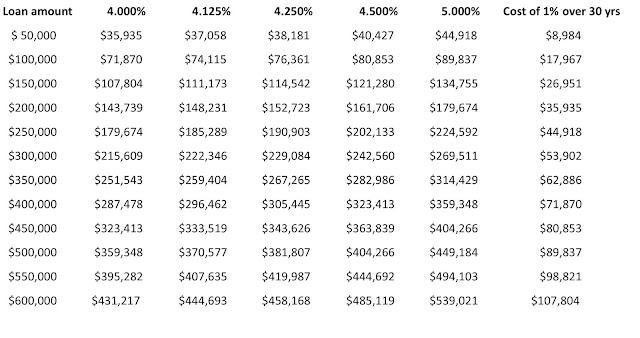

That's not good for many reasons ... and here are some facts and figures that prove why:

- 18% of Americans spend an hour or less searching for a home loan. (per Inman article)

- Few consumers obtain information from outside sources, such as websites, financial and housing counselors, or personal acquaintances (such as friends, relatives, or coworkers) (Consumers Financial Protection Bureau)

- One in four first-time homebuyers report being completely unfamiliar with the mortgage process from the start

- The Consumer Financial Protection Bureau (CFPB) surveyed 5,000 recent home purchasers in a national study. It found 47% of buyers didn’t “seriously consider” more than one lender

- According to a J.D. Power 2016 U.S. Primary Mortgage Origination Satisfaction Study, almost 1 in 5 homebuyers (21%) regretted their choice of lender

- A comparison of buyers' expenditure time/research:

And:

- Nearly half — or 46% — of Americans say they are unfamiliar with alternative down payment options, according to a recent survey conducted by national online lender Laurel Road

All of these stats and info prove ...

Not conducting a thorough search for an Originator ... not taking the time to ask questions and seek answers ... not asking for referrals and recommendations? It costs you money. Big money. It also has great potential to cost you in stress and frustration.

So, how can you avoid becoming just another of the stats above?

Invest in yourself, your financial success, your future ...

Take every opportunity and use every resource at your disposal to conduct research. Start that research early ... well in advance of the time you hope to actually use it. Even a year ahead of when you hope to finance and buy is not too much time.

An online group such as the one I describe above is just one of the many resources available that offer such opportunity, insights, and assistance. Friends, relatives, co-workers, real estate professionals (of all ilk) are also reliable resources.

The bottom line if you hope to avoid Lender Remorse is this ...

Don't fear asking for testimonials and reviews from those you know and trust. Take the time needed to do a thorough check of those Originators you are considering. Use online resources such as YELP, Facebook, etc. to find feedback for local lenders/Originators serving your area.

You'll be far better prepared when you finance your home purchase (or refinance) ... and far happier with the end results.

Should you wish to start a search for mortgage information or assistance in the New Lenox - Will County - Chicagoland area - IL & WI, please consider viewing my testimonials and recommendations ... and website ...

Invest in yourself, your financial success, your future ...

Take every opportunity and use every resource at your disposal to conduct research. Start that research early ... well in advance of the time you hope to actually use it. Even a year ahead of when you hope to finance and buy is not too much time.

An online group such as the one I describe above is just one of the many resources available that offer such opportunity, insights, and assistance. Friends, relatives, co-workers, real estate professionals (of all ilk) are also reliable resources.

The bottom line if you hope to avoid Lender Remorse is this ...

Don't fear asking for testimonials and reviews from those you know and trust. Take the time needed to do a thorough check of those Originators you are considering. Use online resources such as YELP, Facebook, etc. to find feedback for local lenders/Originators serving your area.

You'll be far better prepared when you finance your home purchase (or refinance) ... and far happier with the end results.

Should you wish to start a search for mortgage information or assistance in the New Lenox - Will County - Chicagoland area - IL & WI, please consider viewing my testimonials and recommendations ... and website ...

* Hoping to Buy or Refinance a Home in New Lenox or elsewhere in the Chicagoland area, IL or WI?

Contact me!

I'll put my 40+ years of Mortgage experience and expertise hard to work on your behalf.

I'm easily found at:

Contact me!

I'll put my 40+ years of Mortgage experience and expertise hard to work on your behalf.

I'm easily found at:

Gene Mundt

Mortgage Originator - nmls #216987 - IL Lic. 031.0006220 - WI Licensed #216987

American Portfolio Mortgage Corp.

nmls #175656

Direct: 815.524.2280

Cell or Text: 708.921.6331

eFax: 815.524.2281

Gene Mundt, Mortgage Originator, a Mortgage Originator with 40+ years of #mortgage experience, that will offer you exemplary mortgage service and advice when seeking: #Conventional, #FHA, #VA, #Jumbo, #USDA, and Portfolio Loans in #Chicago and the greater Chicagoland region, including: The #Lincoln-Way Area, #Will County, (#New Lenox, #Frankfort, #Mokena, #Manhattan, #Joliet, #Shorewood, #Crest Hill, #Plainfield, #Bolingbrook, #Romeoville, #Naperville, #Wilmington, #Peotone, etc.), #DuPage County, the City of #Chicago, #Cook County, and elsewhere within IL and Wisconsin.

Your Referrals & Testimonials are Always Greatly Appreciated!

No comments:

Post a Comment

Thank you for taking the time to read and comment on my post!